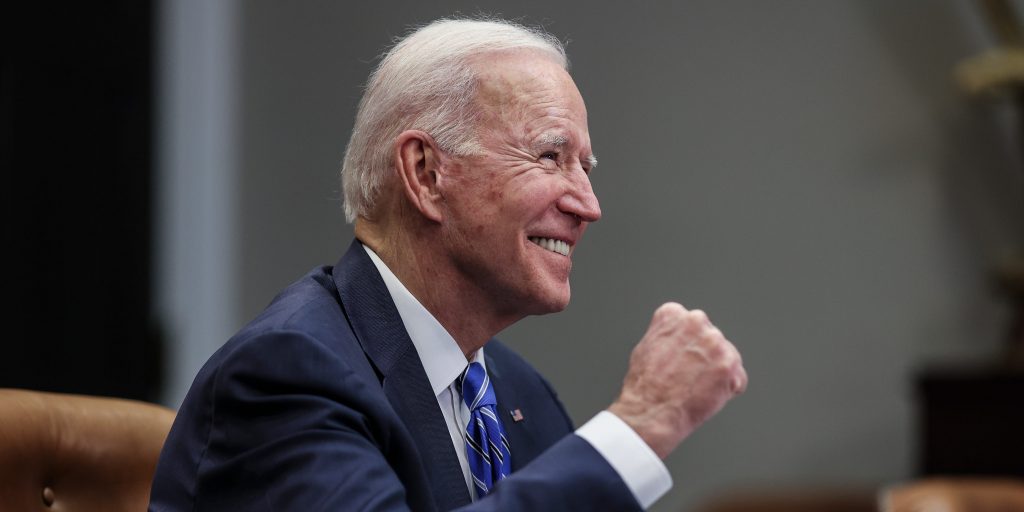

Oliver Contreras-Pool/Getty Images

- The Biden administration said it would start issuing advanced child tax credit payments on July 15.

- It would be issued the 15th of every month unless it falls on a holiday.

- Treasury and IRS estimate 39 million households will receive the cash without needing to sign up for it.

- See more stories on Insider's business page.

The Biden administration announced Monday it is kickstarting the first advanced payments of the child tax credit on July 15. Democrats have touted it as a key part of President Joe Biden's stimulus law and it's poised to benefit the vast majority of American children.

The Treasury Department and IRS announced they would start issuing the payments on July 15 and continue them on the 15th of each month, unless it falls on a holiday.

"The American Rescue Plan is delivering critical tax relief to middle class and hard-pressed working families with children. With today's announcement, about 90% of families with children will get this new tax relief automatically, starting in July," Biden said in a statement.

The $1.9 trillion stimulus law revamped the existing $2,000 child tax credit, widening its reach and beefing up the amount. It was boosted to $3,600 per young child aged 5 and under, and $3,000 for every child between 6 and 17. It also provides households the option to receive a monthly $250 or $300 payment instead of a one-time sum at tax time, the typical way of accessing it up to now.

Families with children can tap into the cash even if they have little or no income tax obligations. The Treasury and IRS said 39 million households will receive the payments with no additional action necessary as either a direct deposit, paper check, or debit card.

The president has urged Congress to swiftly approve the $1.8 trillion economic package called the American Families Plan, the second major infrastructure plan. The proposal would extend the monthly $300 checks for another four years until 2025. But it would continue at a lower amount if lawmakers don't renew it at the bulked-up levels.

Experts are projecting the expanded tax credit would cut child poverty in half, particularly for Black and Latino kids. The non-partisan Tax Policy Center forecasted in March that over 90% of families with kids would receive an average $4,380 cash benefit.

"I think it's about time we start giving tax breaks and tax credits to working-class families and middle-class families instead of just the very wealthy," Biden said earlier this month.

The IRS had said it was on track to begin the stimulus child tax credit payments in July.